Unpacking the Value of Retail Media Networks

By John Carroll, Acosta Group President Connected Commerce + Advanced Analytics

We’ve reached the final chapter in our multi-part series, A Collaborative Trade and Marketing Spend Blueprint. In part one, we discussed the need for a collaborative effort, involving key stakeholders from sales, brand, marketing, and retail teams. In part two, we examined navigating the omnichannel landscape and looking for ways to complement in-store promotions with digital activation and amplification. All are meaningful steps, for certain. But often, there is significant pressure for manufacturers to jump headfirst into retail media networks (RMNs) with substantial investment. Nurturing a trade partner relationship in this environment can be challenging and filled with pitfalls.

Turning Friction Into a Collaborative Pearl

The best way to illustrate how to respond when your trade relationship is under increased pressure is by sharing a recent client experience. Our client, a consumer packaged goods (CPG) manufacturer, was asked to increase their RMN investment by threefold after already increasing the same investment by 40 percent over the prior year. The client was shocked and unable to meet the retailer’s request, so we collaborated with both parties on the best way forward.

We reached out to the retail buyer and shared that the CPG was already leaning in to build extra exposure—running increased paid search year-over-year, supporting in-store promotions with digital ads on the retailer’s platforms and third-party platforms—which led to the current budget levels reflecting a significant year-over-year investment growth. The buyer was open to discussion. We explained that adding more RMN spend wouldn’t tie to activities that would be driving incremental sales. We asked which tactics they could offer that would provide us ROI outside of the current investment.

By bringing this data, a detailed plan, and our point of view to the conversation, we helped the buyer see a different side of the equation. Just because our client’s larger competitors were spending more didn’t mean that a cookie-cutter approach would lead to growth for our client and shared profit for the buyer. Sharing our omnichannel plan and the data-informed tactics to back it up enabled a collaborative and more productive conversation.

Ultimately, both parties agreed on a few additional tactics that better amplified our strategic plan, which increased our client’s budget by 10 percent—significantly less than the original ask. The extra spend in-store would return more incrementality. Key to the negotiations was coming to the table with a detailed ROI analysis of in-store promos paired with our digital plans and the supporting rationale.

Another important ingredient to the conversation was understanding how retailers define “retail media spend”. For example, a digital coupon spent to support a banner ad sometimes comes from trade and doesn’t count toward retail media spend expectations. Frequently, the ask for incremental spending comes from new e-commerce marketing or RMN teams who are inadvertently dipping into the trade bucket even though traditional buyers may not support this use. Be sure to demonstrate the impact of your in-store and online plans to guarantee the next dollar is spent as efficiently as possible for both the client and the retailer.

The Rise of RMNs, and ROI

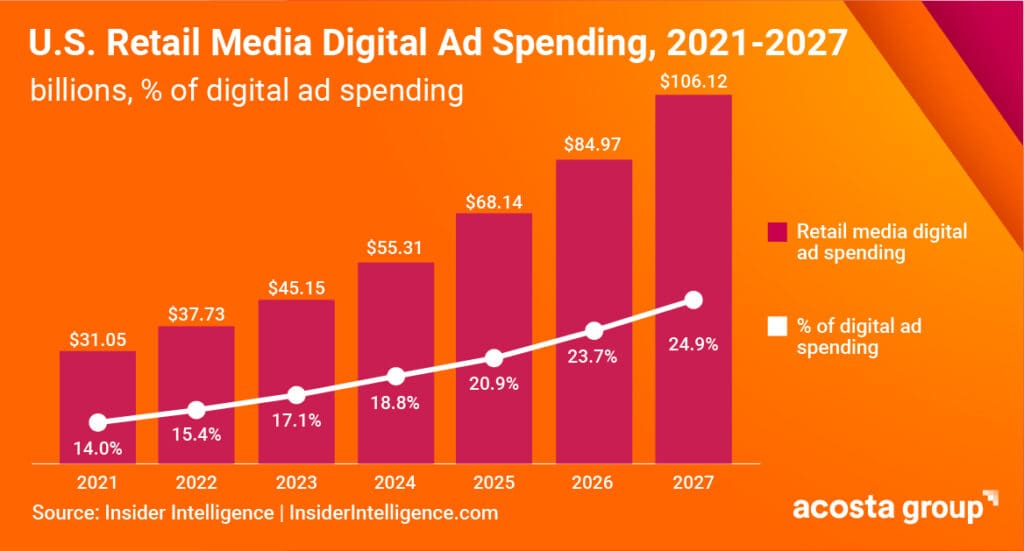

The number of retailer media networks has exploded in the past few years, with CPG digital ad spending at almost $40 billion annually. Often seen as a “tax” by CPGs when forced to participate, RMNs can offer relevant benefits, such as closed-loop measurement and targeting with first-party data to truly drive new shoppers and incremental sales. As retailers look for opportunities to grow revenue by launching RMNs, CPGs need to manage spend expectations and understand how to deliver the best returns.

4 Influential Factors In RMN Spending:

- The RMN’s Shopper Base: A larger or more loyal shopper base represents more advertising impressions and potential revenue for CPGs. As a rule, you should invest more in RMNs that can capture a larger share of your high-value shoppers. For a retailer to make their first-party consumer data addressable (i.e. able to target individual shoppers online), they have to match their data with an identity resolution platform like LiveRamp or Experian. The process typically involves matching shopper data with the data from the resolution platform. You will never get a 100 percent match rate. A 20-30 percent drop-off typically happens during the match meaning that if a retailer has one million shoppers in their database, their “addressable shopper base” will be in the 700-800K range. Baselines vary by retailer, but a good starting point of five to ten million addressable shoppers should be the baseline.

- Ad Inventory and Formats: If retailers are demanding big budgets, they should be allocating resources to develop a wide range of ad formats, such as sponsored product listings, on- and off-platform display ads, mobile display ads, video ads, connected television, native advertising and social advertising. Diversifying their ad inventory attracts a broader range of consumers. Don’t be afraid to challenge RMN partners to provide appropriate solutions in addition to recommending specific ad formats. Always test and learn but make sure you understand how each ad format is performing and its impact on your ROI.

Ad inventory is also tied directly to the size of their shopper base (the larger the shopper base, the more available inventory), an important correlation to remember when developing highly targeted audience segments. If you don’t have a large enough shopper base, the ad frequency will increase beyond the suggested thresholds for big-budget targeted campaigns, which lowers and impedes performance. The IAB (Interactive Advertising Bureau) suggests a maximum of 3-5 impressions or ad views per user for display, 1-3 for video and 3-5 for mobile.

It is also important to understand the fees charged by the retailer on top of media. The cost of the first party data should be incremental to the value it brings. These rates are often never asked about and can often times be negotiated. - Data and Insights: If you feel pressured to spend more with a specific RMN, negotiate increased access to shopper behavior, purchase patterns, frequency and amount, brand penetration, new shoppers, and incremental sales. Don’t settle for off-the-shelf metrics. Request visibility into your brand share online vs. in-store to help guide your spending. Understanding how each retailer collects and analyzes data to inform targeting, optimization and measurement is also best practice.

- Measurement and Reporting: It’s essential to understand how each RMN tracks and reports on key performance indicators (KPIs), such as return on ad spend (ROAS). If the measurement methodology favors the retailers, you may be receiving inflated results to justify your larger investments. It is important that you understand answers to the following questions:

- What is the attribution window?

- Does the ROAS include in-store sales, and what percentage of the ROAS is in-store vs. online?

- Is a control group used to account for naturally occurring sales?

- Can the RMN measure new shoppers and incremental sales?

If you’re investing in or being asked to invest in programs that don’t include robust measurement and reporting, consider pushing back to find common ground and mutual benefit. Access to reliable and actionable campaign performance data is table stakes.

Fragmentation and Our Splintering Perspectives

Fragmentation poses a significant challenge to the effectiveness of retail media. Retail media is rapidly expanding as an advertising channel, mainly because it offers the advantage of tracking how ads lead to sales using data from retailers. However, advertisers are becoming less enthusiastic due to difficulties in measuring ad performance caused by the absence of consistent measurement standards across different advertising platforms. Currently, it’s incredibly challenging for advertisers to make meaningful comparisons between these platforms, potentially resulting in budget misallocation.

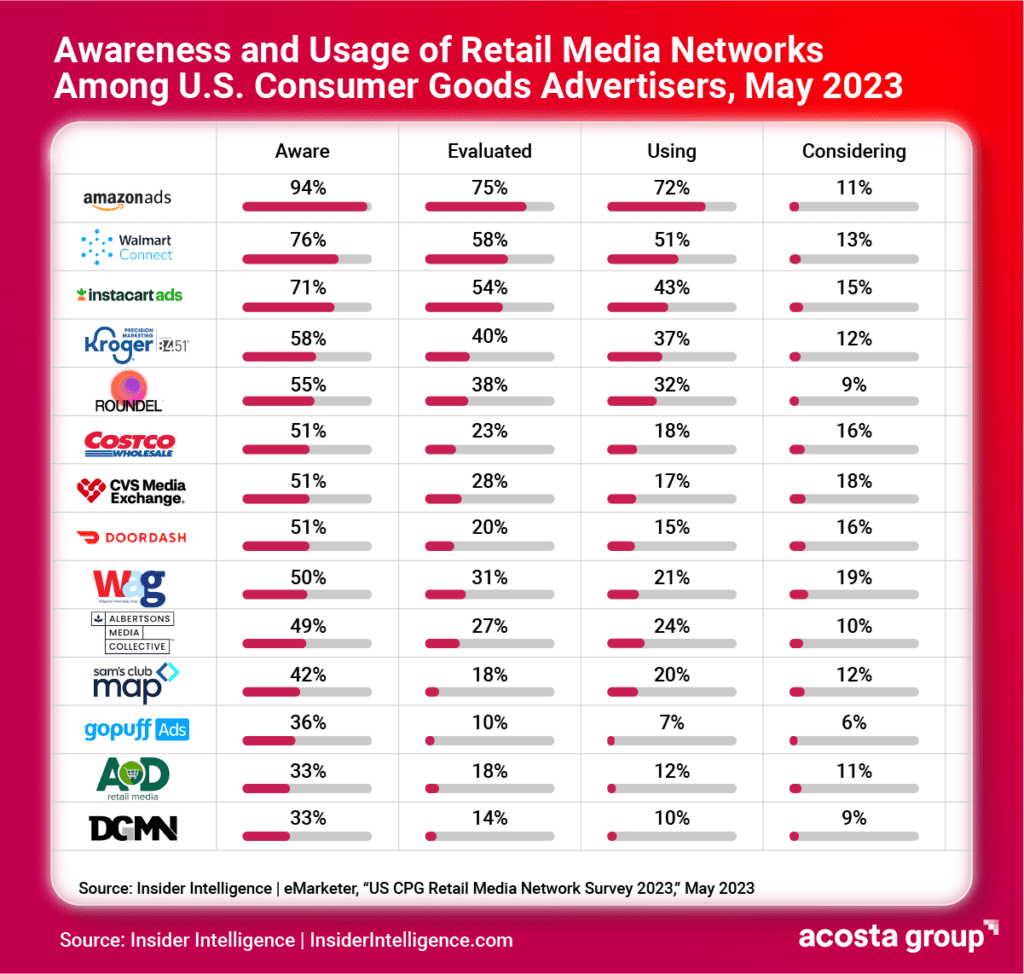

After surveying 116 retail media ad buyers from consumer brands and agencies, Insider Intelligence published a report on CPG Retail Media Networks Perception Benchmark 2023. Respondents were asked to rate the importance of RMN qualities across retailers. Their overall rankings showed:

- #1: Amazon Ads

- #2: Walmart Connect

- #3: Target Roundel

- #4: Kroger Precision Marketing

- #5: Ahold Delhaize AD Retail Media

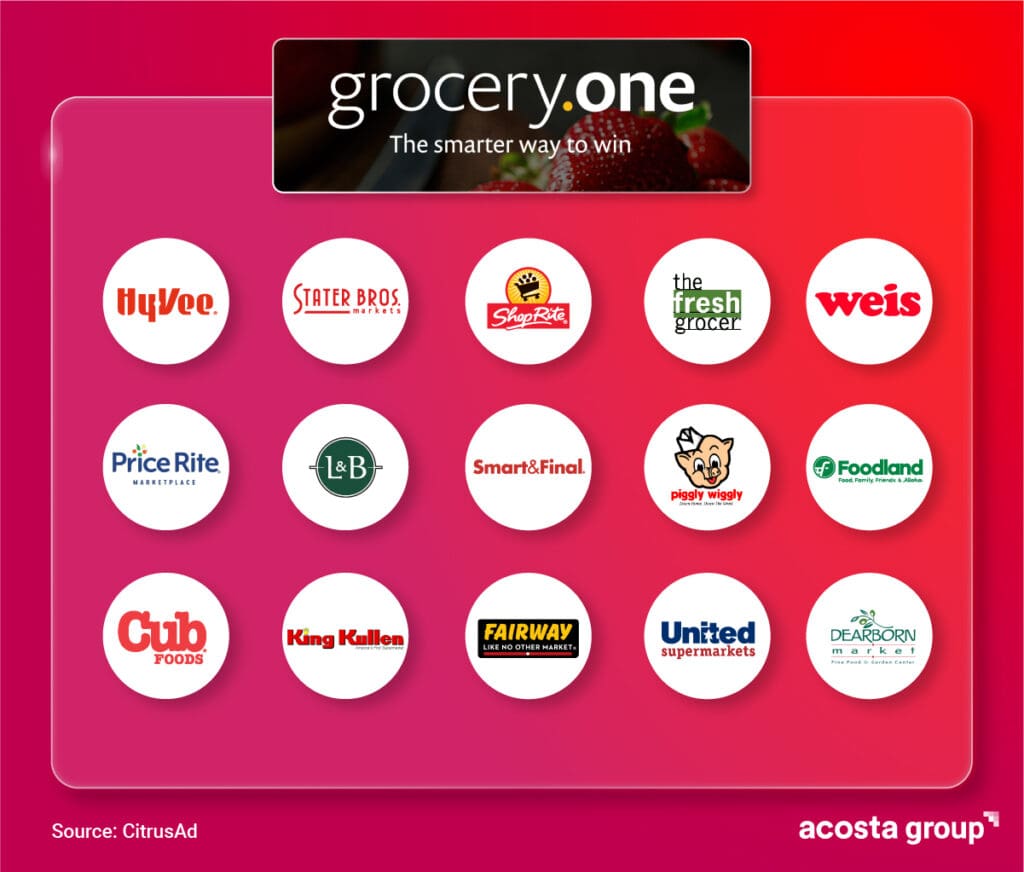

While this survey showed which RMNs are broadly being considered and used, we would be remiss to not mention regional RMNs. Often the regional players don’t have the large tech investment needed to make as broad of an impact, but as a workaround they are partnering with CitrusAd or Criteo to build it out. CitrusAd has consolidated some of the smaller regional grocers that they manage under a network called “Grocery One” which allows a larger combined audience across regional grocery. Both Hy-Vee and Meijer are leading the regional pack by bringing in partners and strong talent leading to growth.

Finding Your Voice Among RMNs

To achieve impactful results for your brand among RMNs, involve all relevant teams in your planning and strategy. While not every team member needs to be present at every meeting, you can streamline communication by designating a central point of contact. This approach ensures that everyone is aligned with your stated goals and objectives.

Use the contact model that works best for your organization. The single model appoints a central contact person who works across all teams. This model can streamline communication but may add complexity. The team model establishes a contact from each team who works directly with the retailer. This model ensures the retailer can access each team’s experts but requires internal alignment. The outsourcing model places your retail media strategy with an agency that coordinates communication with one or more retailers. This model can enhance efficiency, but agency effectiveness may vary. Finally, the shopper model designates the shopper marketing team as the primary point of contact, expanding the current partnership between retailers and shopper teams.

From the retailer’s perspective, it’s vital to be transparent in data, measurement, and performance attribution. One retailer may have a different measurement approach than the next, making transparency about attribution models and methodologies a relevant starting point for negotiations with CPGs. Retailers can enhance transparency by sharing more data and insights with brands. For example, self-service platforms like The Kroger Co. provide brands more control over their campaign data and performance, including audience targeting, message design, budget optimization, and reporting.

Another important consideration is the transformation of KPI ownership. Traditionally, sales, e-commerce, and marketing have all been involved, but typically each had their unique areas of stewardship. Now, the lines have blurred and what used to be a metric that was solely owned by e-commerce, for example, should be jointly owned by all functions to ensure the best omnichannel outcome. Organizations should shift toward shared accountability and collaborative management of all performance metrics deemed critical to the organization. Key examples of these are shown below:

The Future Looks Collaborative

Collaborative partnerships between advertisers, retailers, and media companies are already underway, allowing for better targeting and engagement, especially in the upper funnel stages of the shopper journey. For instance, Disney’s partnership with Kroger enables brands to target streaming audiences more accurately using shopper data. Other recent partnership examples include Albertsons Companies and Omnicom Media Group, Dollar General and Meta, and Lowe’s partnering with Roku, TikTok, and Snap. Partnerships of this intention and caliber expand audience reach and aim to engage shoppers earlier in the purchasing journey, moving beyond the bottom-of-funnel approach.

Rewiring Physical Stores for Digital Media

Digital ads in physical stores are having a moment. More and more stores are using screens for ads in various in-store locations, such as the entrance, checkout counters, and more.

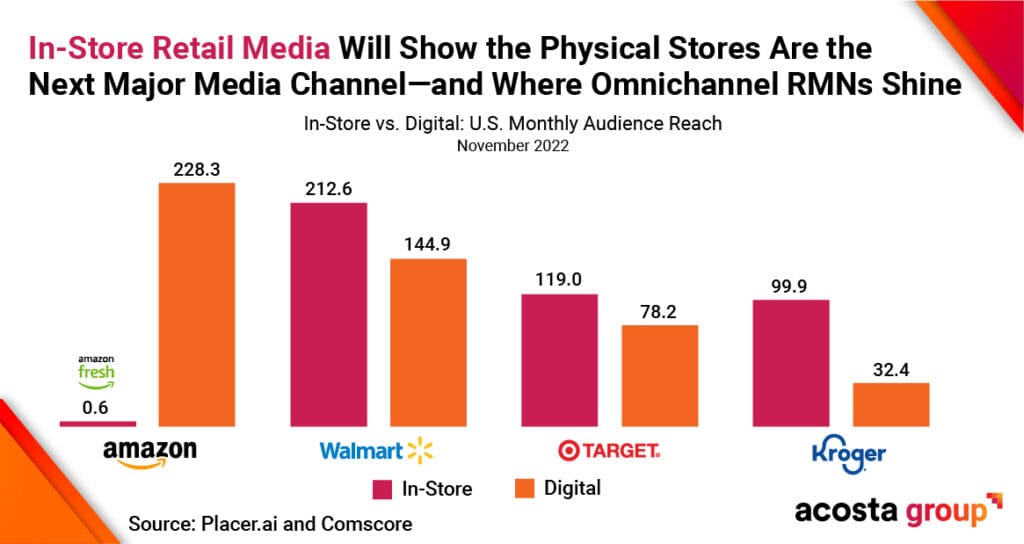

In-store retail media is the next logical expansion of RMNs since brick-and-mortar stores are the most significant source of untapped digital marketing space. At Groceryshop 2023, Andrew Lipsman of Insider Intelligence shared that in-store media will demonstrate how physical stores are the next major media channel and will further elevate the importance of RMN investment.

Brands can now show shoppers ads to match their interests while they’re in the store and when they’re about to buy. The bigger stores can reach millions of shoppers each month, similar to major media channels. The monthly in-store audience at Walmart dwarfs many TV show audiences and could lead to more competition for traditional advertising/media dollars.

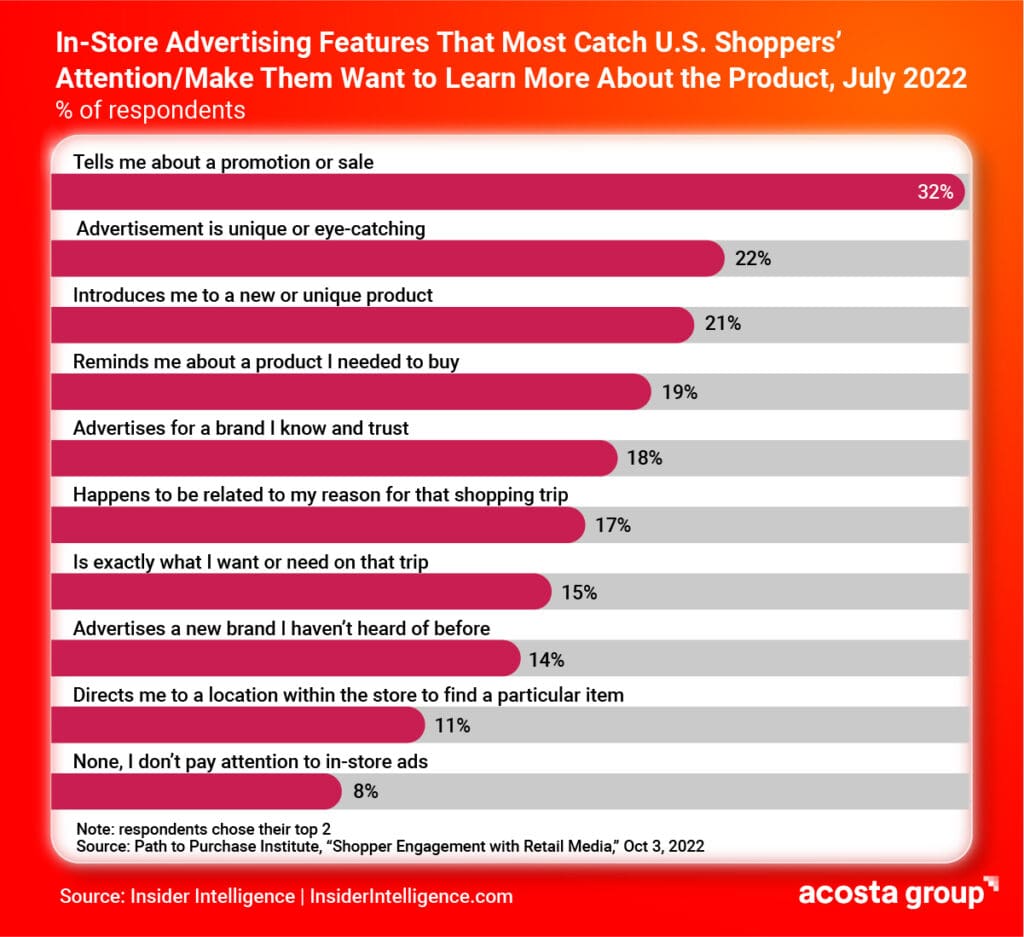

According to a recent study by the Path to Purchase Institute, shoppers actually like in-store ads if the content is helpful and eye-catching. And because these ads can also make money for the stores, we believe in-store retail media is a win-win-win scenario. Shoppers get helpful information that enhances their journey, brands can capture potential customers, and stores can increase basket size while providing a better shopping experience. And that’s just the beginning.

Adding digital to physical stores will also help retailers compete with online shopping. Traditional stores face tough competition from online retailers like Amazon. To stay in the game, traditional stores must match the information and convenience that online shopping offers while still providing the unique in-store experience.

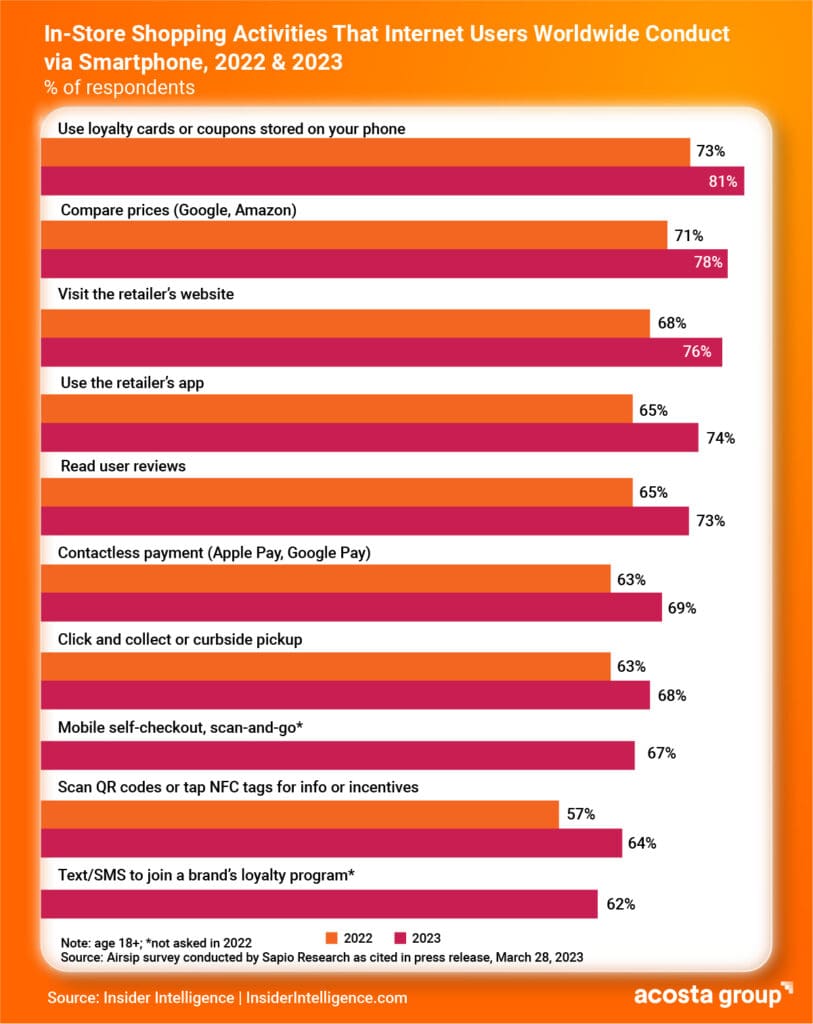

Smartphones also play a central role in omnichannel shopping and digital spending. From loyalty apps and price checking to curbside pick-up and mobile checkout, phones have transformed how we shop. According to a March 2023 Airship study, shoppers will soon want physical stores to have smartphone-like capabilities built right in.

The Media Mix is About to Get Mix-ier

RMNs have already made a significant impact on omnichannel strategy and planning, and they’re here to stay. More recently, they are expanding beyond the digital space into physical stores where shopper behavior continues to evolve. With the landscape getting busier, an adversarial theme has emerged in the relationship between CPGs and retailers, further highlighting the need for a collaborative approach to RMNs by both parties to arrive at effective and equitable solutions.

The budget is the budget, until it’s not. RMN dollars compete with other investment buckets, such as trade, e-commerce, shopper marketing, and traditional media spend. But not all RMNs perform and measure the same way. The mature ones are delivering more incremental sales and are viewed as less of a tax on CPGs. Retailers sometimes forget that if their platforms outperform other forms of media, then the dollars will redirect in their favor. Retailers who focus on improved measurement and share data transparently will be better positioned to win larger portions of the media dollars in the future. As you determine the RMN budget for your brands, we recommend ranking each RMN based on metrics of scale, capabilities, clarity of measurement, and ease of platform use. That way, you can lean into collaborating with the highest performers as you execute your omnichannel plan.

Collaborate Your Way Through an Evolution

The lines between physical and digital continue to blur, placing increasing emphasis on a solid omnichannel plan to achieve your organization’s goals. Breaking down organizational silos to strategize and plan together, holistically—with strong support and alignment from Marketing, Sales, E-commerce, and Shopper—is no longer an option. It’s imperative. Identify goals. Spitball a plan. Ballpark a budget. And make sure you are accounting for both digital and physical store investments. Ask yourself what’s missing. Who is missing? Invite them into the conversation, revisit everything, and build a winning strategy.

We hope these helpful tips provide a comprehensive blueprint for driving shared sales and marketing performance. To our CPG and retailer partners, we’ll see you on the journey.