Shopping with Purpose: How American Consumers Prioritize Wellness and Sustainability

Natural, organic, plant-based and otherwise sustainable products are more than a statement. They are a

lifestyle and a commitment to better health and environmental impact.

Americans are increasingly making healthier choices for themselves, their families, and the greater good.

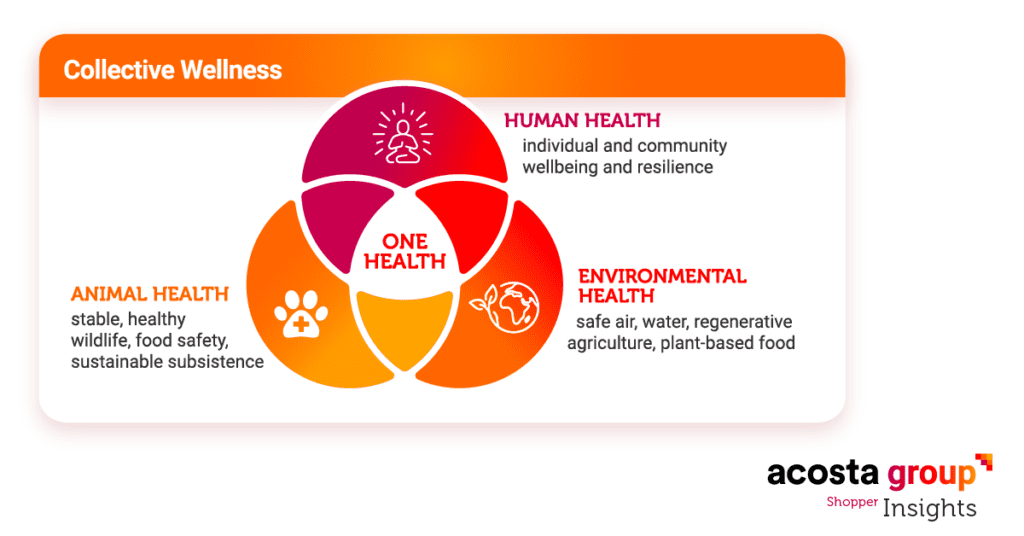

Acosta Group predicted that in 2023 the comprehensive meaning of wellness would continue to expand

beyond oneself to encompass animals and the environment collectively.

Now, from several research studies conducted in 2023 with Acosta Group’s proprietary Shopper Community, we have identified three themes of collective wellness:

- Good for health – elevating the overall wellbeing of myself and my family

- Good for the Earth — making sustainable choices that benefit the Earth

- Good for animals — cruelty-free and meat alternatives yield positive outcomes

Consumers now think more holistically about how their actions and consumption can maximize their

impact. The themes reveal how consumers’ broader meaning of wellness is reflected in the products they buy, including natural, organic, sustainable, and plant-based, and what it means for retailers and manufacturers.

Good for Health

Shoppers are motivated to buy natural, organic, plant-based products and functional ingredients

because they see them as better for themselves and their families.

These choices are fueling the growth of the natural and organic products industry. According to

New Hope Network, natural and organic U.S. sales are on track to reach $300 billion by 2024

and $400 billion by 2030, with sales dominated by food and beverage (38%).

No longer a niche, we now see that:

- Health goals are a driving force. A majority (63%) of natural and organic shoppers choose these products because they are “better for me”. An even larger majority (81%) of natural shoppers see the products as a good fit for their health goals. Natural and organic products have become mainstream, especially for younger generations. Gen Z, in particular, wants products that fit with their diet and nutrition goals, and virtually all of this generation is buying natural or organic. Similarly, for established plant-based users (eating plant-based for two years or more), the primary influences on choosing a plant-based diet are health (57%) and nutrition (46%).

- Non-food natural and organic also gaining interest. It is not just food and beverages driving interest among shoppers in the natural and organic space; beauty care, vitamins and supplements are a key part of their overall health and wellness and among the most popular natural and organic categories.

- Ingredients come under scrutiny as they seek healthier products. For natural and organic shoppers, ingredients (30%) are as important as price (33%). These shoppers desire clean ingredients, functional ingredients, and products that are “free-from” chemicals, synthetics, or pesticides. They want products that are not processed.

Good for the Earth

Consumers increasingly select sustainable products because they are good for the Earth,

fueling category growth. In fact, according to NielsenIQ, the growth of sustainable products

with environmental, social, and governance (ESG) claims is higher than for conventional products without ESG-related claims. Our research shows that:

- Sustainability matters most to the youngest generations. A total of 45% of shoppers consider sustainability extremely important when purchasing consumer packaged goods (CPG), and it is even higher for younger generations—59% of Millennials and 51% of Gen Z consider it extremely important. Gen-Z is also most willing to pay a higher price for sustainable products (36% vs. 24% of all shoppers).

- Natural/organic and plant-based products are better for the environment. In addition to the health reasons mentioned above, natural and organic products are perceived as better for the environment by 83% of buyers. A third of those eating plant-based foods are influenced by wanting an environmentally friendly option.

- Sustainable practices such as regenerative farming are becoming more prevalent across both natural and conventional products. As consumers look for additional ways to decrease their carbon footprint, regenerative agriculture has emerged as a way to help store carbon to mitigate the effects of climate change, improve air and water quality, and enhance ecosystem biodiversity.

Good for Animals

Concern for animal welfare is prevalent across many groups of shoppers, with natural and organic products and plant-based products appreciated for their animal-friendly benefits. There is even growing interest in animal-friendly products among conventional shoppers who are not yet involved in these categories but express an interest.

- Gen Z is most concerned about animal welfare. Gen Z natural or organic shoppers are more likely to purchase cruelty-free products than older generations. Animal welfare is also a key factor for over half of Gen Z long-term plant-based users (two or more years) in choosing plant-based products.

- Animal-friendly labeling resonates with conventional shoppers. Interestingly, conventional shoppers who do not buy natural or organic products gravitate more toward cruelty-free messaging (33%) than Made with Certified Organic messaging (3%). They are also interested in product certifications of 100% Grassfed (23%), Animal Welfare Approved (22%), and Dolphin-Safe (19%).

Barriers to Adoption

While this broader category of wellness products continues to grow, only some shoppers are on board. Our research shows that while wellness factors are increasingly important in product selection, significant barriers exist.

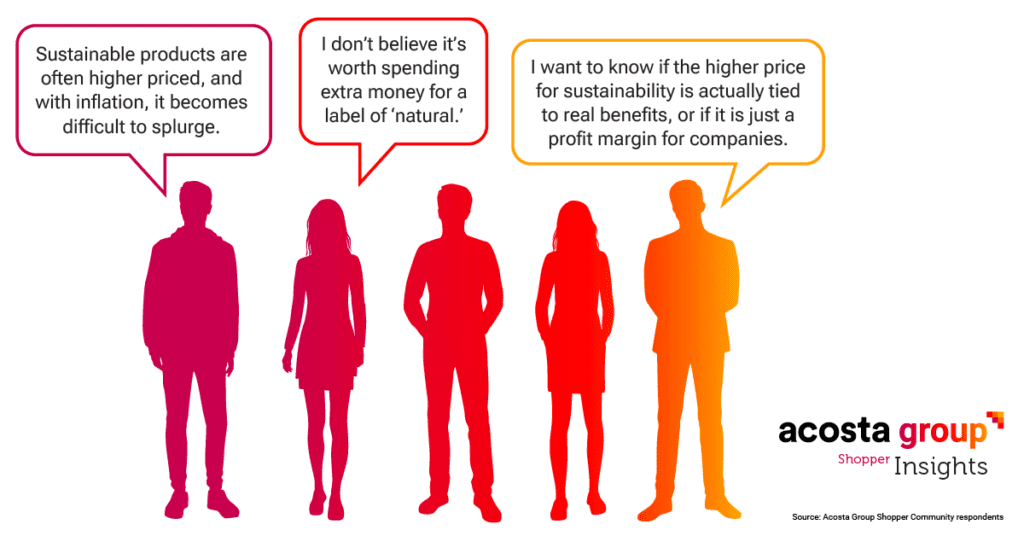

- Cost is a primary barrier, especially in inflationary times. About half of shoppers think sustainable products are too expensive, and half are less able to choose sustainable options due to inflation. Similarly, 73% of shoppers believe natural products are too expensive.

- Consumers are confused. Shoppers have a moderate understanding of sustainability, primarily describing it in terms of the environment (44%) or about “reduce, reuse, recycle” (25%). And there is confusion over the difference between natural and organic, with many saying the two are “similar” or that they are “unsure” if there is a difference between them.

- Many do not believe the hype. Forty-four percent of shoppers who do not purchase natural or organic products “don’t believe the hype about natural.” An increasing level of consumers, especially Millennials, believe plant-based products are a fad. Indeed, sales are starting to lag, with sales of plant-based refrigerated and frozen meat down 8% compared to a year ago, according to SPINS.

- Awareness is low. Retailers’ sustainability efforts often go unnoticed. A third of shoppers do not typically notice retailer efforts around sustainability, and half would like to see more investment in this area. What do they notice? Top of mind is shopping bag options (such as reusable or paper bags) and charging for plastic bags.

How Retailers and Manufacturers Can Earn Shoppers’ Trust

Retailers and manufacturers are keen to fuel this broader wellness mindset with category growth. But they must break through consumer skepticism to convince shoppers that there is true benefit in paying a premium for sustainable, natural, organic and plant-based products. Consumer messaging must evolve to appeal to increasingly sophisticated wellness motivations—good for me, my family, the earth and animals. Our research shows there are opportunities such as:

- Build product trust through straightforward ingredient labels. Close to half of natural and organic shoppers believe certification labels are very important. Specifically, shoppers comprehend the simple, straightforward certifications such as Non-GMO verified or USDA Organic. Manufacturers and retailers need to do more to alleviate confusion around natural versus organic. Soon, there won’t be a choice. The U.S. Department of Agriculture will implement sweeping new rules in March 2024 designed to assure consumers that “organic products meet a robust, consistent standard and to reinforce the value of the organic label.”

- Highlight sustainability commitment through selective use of ingredients and packaging. Consumers are looking to make a difference through their purchases. Brands can partner with consumers in achieving this goal by utilizing and calling out ingredients that are organic, natural, regeneratively farmed, or plant-based. Brands can expand on this commitment by reducing packaging, eliminating plastics, and utilizing more climate-friendly packaging options. As an example, Amazon encourages manufacturers to participate in their “Climate Pledge Friendly” program by securing third-party certifications on products that improve at least one aspect of sustainability.

- Secure interest through more selection and innovation. A broad selection of natural, organic, and plant-based products will become table stakes for retailers. While a two-thirds majority of natural and organic product shoppers are happy with the selection of products at retail, the non-natural shoppers need more options to win them over and further grow the segment; more than 25% are dissatisfied with the selection. Similarly, over half of plant-based users want to see more plant-based offerings at their primary retailer. The boom in plant-based innovation shows that consumers are willing to pay a premium when something new is offered.

- Build awareness through digital marketing and clear in-store signage. Most plant-based users rely on brands, retailers, and the media for information on plant-based products. Make wellness information easily accessible on e-commerce brand stores and product pages. Feed the need for information with bite-sized educational snippets on social media and in promotional newsletters. Clear and distinct signage in-store will help new and prospective users find and learn about plant-based options. Retailers like Kroger use specific signage to help customers locate products; others place plant-based products next to animal-based options.

The Acosta Group Shopper Community is comprised of over 40,000 demographically diverse shoppers across the U.S. and is our proprietary community for survey engagement. This report includes findings from the following studies:

- Acosta Group Sustainability Shopper Insights and Trends, May 2023

- Acosta Group Natural & Organic Shopper Insights, January 2023

- Acosta Group Plant-Based Shopper Insights, July 2023

- Acosta Group Natural-Organic-Sustainable Qualitative Immersion, April 2023