Affordable and Accessible: Dollar Stores Meet Shoppers’ Needs

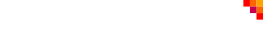

Faced with lingering inflation and higher prices on routine purchases, shoppers seek value wherever they can find it. The dollar channel and club and mass retailers are reaping the benefit. According to Kantar, dollar store channel sales have risen 150% since 2018, accounting for $68.9 billion in sales in 2023 and are expected to reach $87.5 billion by 2028.

The channel struggles with media reports of shrinkflation, store closures, and restrictions on new store openings in some towns. Despite these challenges, the dollar store channel is thriving.

Acosta Group’s proprietary Shopper Community research shows how dollar stores have become more relevant, meeting the evolving needs of today’s consumers.

Dollar Stores Emerge as Essential Stops for Everyday Shopping

No longer just a place for party or project supplies, dollar stores are now an essential part of routine shopping for many consumers, with 69% shopping this channel for more than five years.

- Dollar stores are now a routine grocery shopping destination. One in three dollar store shoppers buy at least half of their groceries at dollar stores. 32% shop the channel once a week or more, and more than a third (36%) shop two or three times a month. Men are more likely to buy groceries at their local dollar store.

- Trips are planned and purposeful. Almost half plan regular trips every week or two, primarily for groceries and household needs. Seven out of ten plan quick trips to grab something they need.

What is driving the rise of dollar stores as an essential channel? Consumers tell us that it’s convenient locations (72%), everyday lowest prices (68%) and the best value for their money (53%). Dollar stores are also:

- Attracting new-to-channel shoppers: 30% of dollar store shoppers are new to the channel within the past four years. According to Kantar, 44% of new dollar channel shoppers (within the last three years) already use dollar stores as their primary retailer.

- Bringing in more frequent shoppers: One in four make more trips than a year ago, as dollar stores appeal to Americans with strained household budgets.

- Making it easy to shop. Dollar store shoppers who prefer the channel for grocery shopping do so because it is easy, convenient, fast and offers everyday low prices.

What’s the opportunity? Cover the basics:

- Optimize and increase consumable assortments as shoppers look beyond grocery stores to dollar stores for lower prices on regularly bought items.

- Ensure clean, organized, uncluttered stores with in-stock products for a fast, easy trip.

Shoppers Stock up on Family Treats and Household Basics

As more shoppers turn to dollar stores for their routine shopping, what are they buying? Snacks, pantry, and household items for the family top the list, while there is an opportunity for more fresh offerings:

- Treats and pantry items are top food purchases. Two in three shoppers buy candy, and three in five buy salty snacks, cookies, and crackers. Pantry items such as canned food, condiments, and spices are also a draw. Candy and snacks are also a favorite impulse purchase.

- Household and family items are top non-food purchases: About half of shoppers buy oral care, paper products, cleaning supplies and batteries, which are also among the top products bought exclusively at dollar stores.

- Fresh foods are an opportunity. Most dollar store shoppers go elsewhere for fresh food. Only 15% of dollar store shoppers buy fresh fruit, produce or freshly prepared foods at dollar stores, but they want to see more offerings.

- Shoppers experiment with new items. They are willing to try new products at dollar stores that may be cost-prohibitive elsewhere.

What’s the opportunity? Gain more share of basket:

- Offer an expanded assortment of items currently bought elsewhere, such as fresh produce and freshly prepared foods. Through in-store displays and digital activations, remind shoppers to pick up items like coffee and pet supplies.

- Provide a deeper assortment of popular and impulse snack and candy items, including healthy options.

Name Brands, Natural and Organic Products Elevate Quality Perceptions

Dollar stores meet most customers’ expectations, but there is an opportunity to raise their perceptions of store quality with name brands and natural or organic products. Shoppers tell us that:

- Product quality meets expectations. Seven out of ten shoppers think the products at dollar stores are medium quality, while almost one in four consider them high quality.

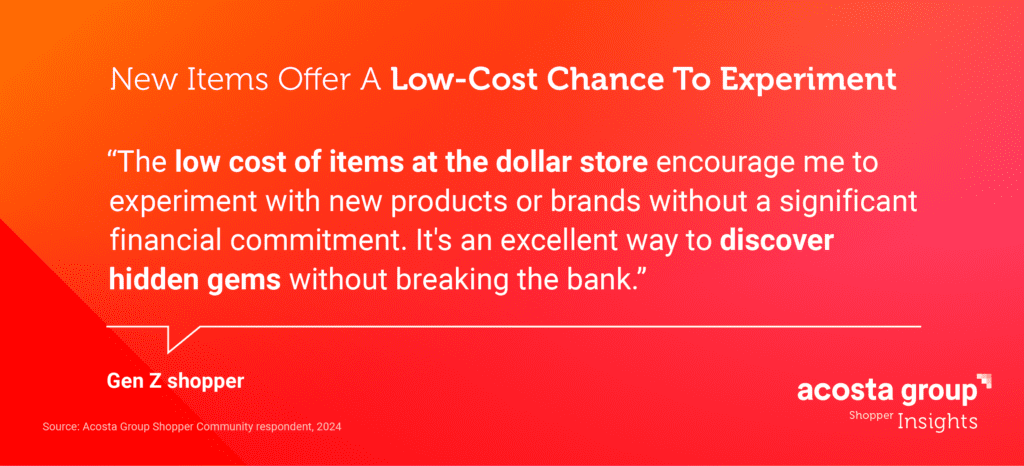

- Name brands offer good quality at a good price. Many shoppers buy name brands at dollar stores all or some of the time because they provide good value. However, more of these shoppers also buy them elsewhere, indicating an opportunity for dollar store retailers. 25% buy name/national brands on all or most trips to dollar stores, compared to 39% at any channel.

- There is a demand for more natural and organic items. A Boomer shopper told us, “I like to eat healthy, but dollar stores do not have much selection.” About a third of shoppers buy natural or organic products at dollar stores at least some of the time. There is an opportunity gap for dollar store retailers as shoppers satisfy this need elsewhere; 43% buy these products in any channel.

What’s the opportunity? Expand offerings to drive quality and trial:

- Name or national brands drive value and quality.

- Natural and organic offerings meet more of shoppers’ needs and encourage trial.

- New items encourage experimentation.

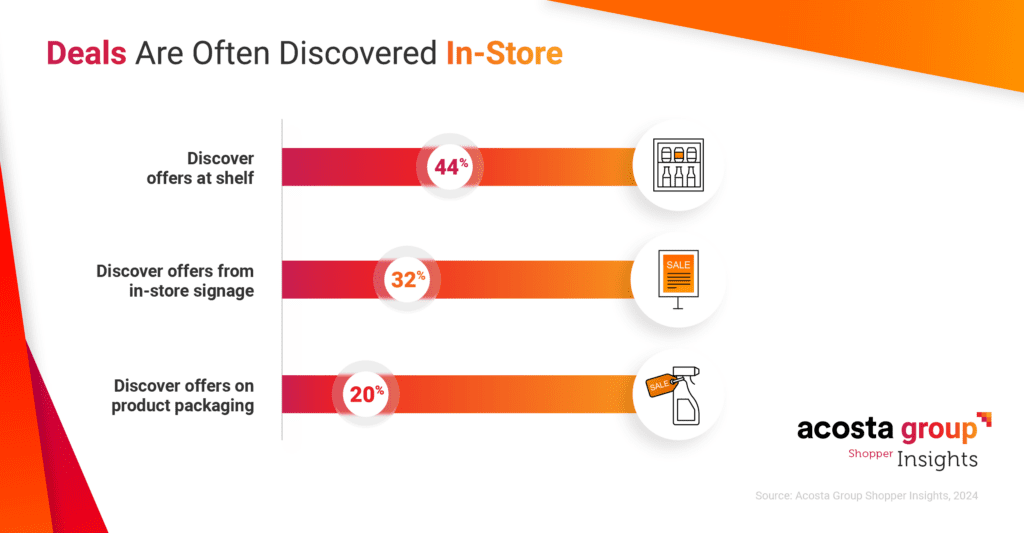

In-store Signage Drives Deal Hunting; Digital Is an Opportunity

With price and value driving shopper demand, in-store signage is critical to communicating deals. Yet, dollar retailers can do more to integrate digital fully. Our research shows that:

- In-store communications are crucial for highlighting deals. For many shoppers, sales and deals are discovered in-store. 44% discover offers from price tags highlighting deals on the shelves, while 32% learn from signage in the store.

- Loyalty apps are untapped. A third of dollar store shoppers belong to a retailer’s loyalty program, and two in five have downloaded the app to receive alerts on sales, promotions, or weekly specials. Yet less than a third (29%) discover promotions or deals this way.

- Millennials like a deal. They are more likely to belong to a dollar retailer’s loyalty program and to have downloaded the app. They are also more likely to buy a familiar item on a deal, even if they don’t immediately need it.

What’s the opportunity? Emphasize value:

- Ensure prominent in-store signage to communicate price changes and deals.

- Promote loyalty programs to deepen relationships and stay top of mind, especially through apps.

Key Takeaways

The surge in new dollar store shoppers underscores a shifting retail landscape. Brands must recognize dollar stores as essential retail outlets. These stores:

- Satisfy real needs: Dollar stores are part of shoppers’ weekly shopping routines.

- Offer real brands: The presence of national brands is raising perceptions of quality and value, as shoppers trust familiar labels and name brands.

- Provide a real opportunity: Dollar store shoppers are open to new offerings such as natural or organic products, and fresh, frozen, and refrigerated foods. Dollar stores also offer a low-risk environment for shoppers to test innovative or niche products at a lower price point.

- Must deliver on table stakes’ expectations: To continue to retain and attract new customers, dollar stores need to ensure they offer an easy, enjoyable in-store experience that covers the basics. Ensure clean, organized, uncluttered stores with in-stock products, for a fast, easy trip.

Sources:

- Fortune, Business Insider, USA Today

- Acosta Group Dollar Shopper Community study, January 2024