A New Approach to Marketing and Trade Spending Models

By John Carroll, Acosta Group President Connected Commerce + Advanced Analytics

The traditional approach of deploying a marketing mix and then analyzing it to gauge and optimize effectiveness is no longer as clear-cut as it once was. Today’s fast-changing landscape demands an answer to the daunting question manufacturing clients ask us every day:

“What are the best investments to drive incremental growth?”

The answer is not as complicated as the challenge but does require a fresh perspective on market forces and their impact on traditional sales, marketing, and trade spending models. The escalation of digital commerce over the last decade has shattered the boundaries between shopper marketing, e-commerce, trade, and media budgets.

The sales and marketing ecosystem has been disrupted, compelling companies and their brands to navigate unfamiliar territory and redefine their strategies. Meanwhile, the emergence of complex and hard-to-measure tactics further compounds the uncertainty across disciplines and categories. And when we consider forces outside the industry, such as inflation and recession fears, it’s easy to imagine the extra scrutiny leveled on strategic investments intended to achieve efficiency and boost sales.

So here we are—manufacturers and retailers are at a crossroads in a world where shoppers hold the reins. They must form unprecedented alliances fueled by innovation and driven by a shared vision. We need bold solutions that cater to the desires of cost-conscious and convenience-seeking consumers while also solving the profitability and productivity puzzle faced by retailers. We must reshape the very essence of consumer experience, retail prowess, and manufacturing ingenuity.

We propose a collective spending model rooted in consumer shopping behavior and contextual preferences. Within this landscape lie the secrets to uncovering value for consumers, retailers, and manufacturers alike. Conventional wisdom and siloed budget allocations are replaced with strategic optimization, where marketing and trade spend models are not just tweaked but reinvented to their core. No longer confined to the limitations of the push-pull paradigm, this collaborative approach embraces an all-encompassing, omni-shopper investment model—a model that updates the investment strategy and ushers in an era of undeniable value for every stakeholder involved.

In this multi-part series, Acosta Group will deliver a comprehensive trade and marketing spend roadmap for manufacturers and retailers, clearly focused on achieving shared sales and marketing performance. This strategic roadmap will include how to optimize pricing, promotions, displays, e-commerce investments, and marketing/media tactics that align with the demands of the present market and consumers. Implementing this roadmap within an organization must be a collaborative effort, involving key stakeholders from sales, brand, marketing, and retail teams to ensure a well-rounded and effective solution.

Where Do We Start?

Clients often ask, ”How can we optimize our current spending?” We have seen significant shifts in media spending. If current growth rates continue, retail media ad spending is expected to overtake traditional TV spend in 2025, with 60-70% of retail media dollars being “net new to retailers” in 2026. The remainder of spending will come from existing retail revenues like trade budgets, sponsorships, events and promotions. Much of this “net new” to retailer spending will materialize as shifts away from traditional media, especially TV. Turning the dial to a collective budgeting approach is crucial. Retail media investments must enhance and amplify current trade spending and can no longer be managed separately.

Your brand and product are intentionally differentiated within the marketplace, so why not differentiate your budget? Advertising budget allocation can vary significantly depending on the company and product category, so understanding your specific allocation by bucket is an important first step in identifying where to look for opportunities. The nature of your product category can also influence the advertising mix. For example, if you are in a highly competitive category, you may need to invest more in trade spending to gain distribution and shelf space.

New Roadmap, New Destination

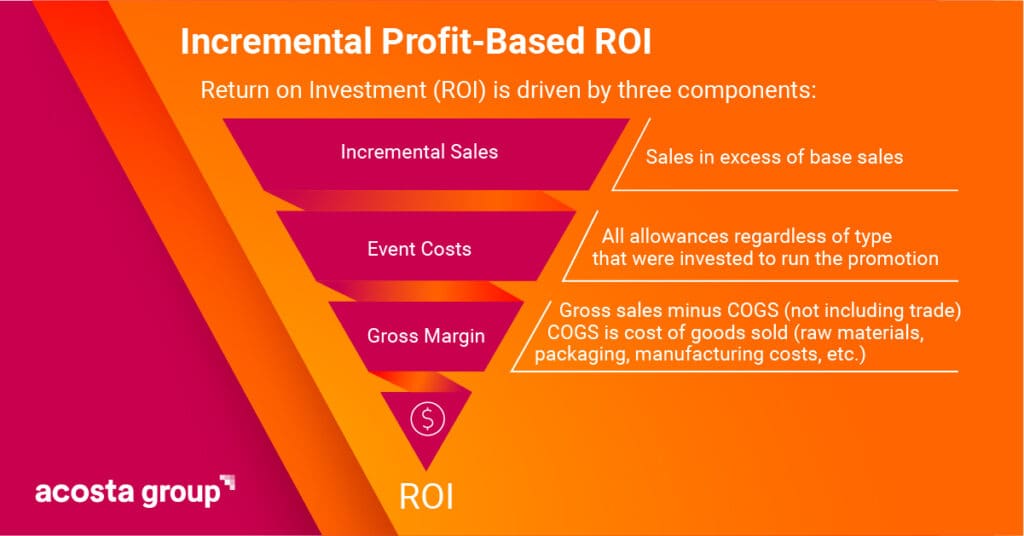

NielsenIQ highlighted that trade promotions account for over $213B per year in the U.S. alone and are second only to the cost of goods sold on a manufacturer’s P&L. Unfortunately, sales teams who are planning promotions often don’t have complete visibility to profitability and are relegated to measuring success on volume uplift or cases sold on promotion. This often results in subsidizing volume that would have sold without a promotion, leading to wasted trade spend.

In a pre-pandemic analysis, NielsenIQ also reported that 72% of trade promotions were not profitable for manufacturers, which equates to $150B of inefficient trade investment. Couple this with declining in-store promotion effectiveness (due to recycling the same types of promotions or relying on the outdated “anniversary method” of planning), and it’s easy to see why performance is guaranteed to worsen.

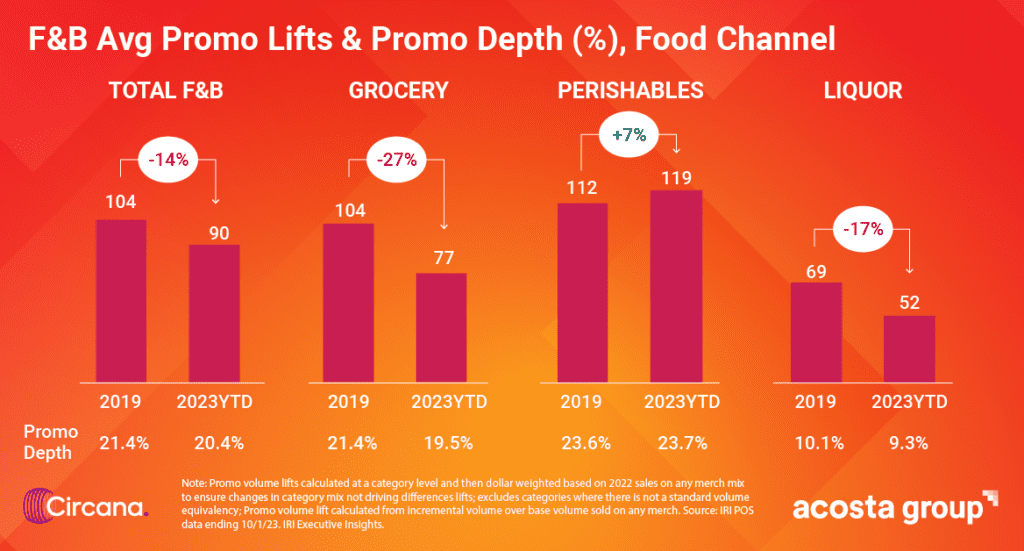

With the waning efficiency of in-store promotions and the new pricing levels due to record inflation, our clients wonder what the optimal promotion strategies, tactics, and price points should be to drive the most incremental growth.

Drive Incremental Growth in Three Steps

Leveraging the data and insights from this three-step analysis will prepare your teams to have more effective conversations with retailers on improving promotion strategy.

- Perform a deep dive on all promotions in the last few years. Look at promotion ROI versus incremental retailer revenue to see which tactics are the most profitable and which are not delivering profitable returns. Identify promotions you want to halt and promotions you recommend are increased in frequency, and reallocate funds to higher-performing promotions that can have an immediate impact.

- Leverage the voice of the consumer to understand which promotions resonate most. It’s time to forget the “set it and forget it” annual promo strategy. Customized research is extremely beneficial for understanding the intended uplift for various consumer promotions for you and your competition. Test and learn the new tactics or price points in-store and measure impact. We hear from retailers that they are open to testing new strategies, so now is the time to collect input from the consumer, formulate a new promotion accordingly, and then measure the performance.

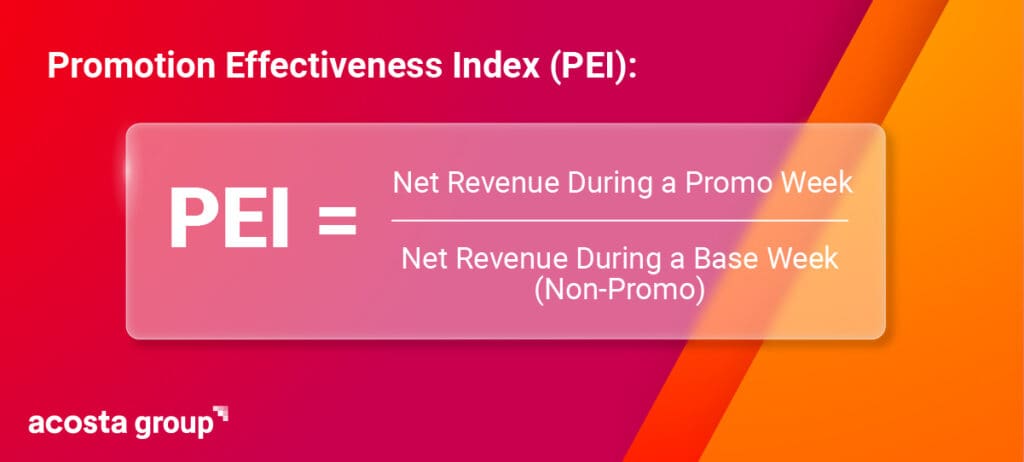

- Train your organization to evaluate promotion performance with data-driven discussion.

Numbers have a story—you should listen. If a promotion has negative ROI for your brand, it will not be sustainable long-term. Having this discussion sooner rather than later will have the most impact. Sharing information on profitability rate for a typical week versus a promoted week (using indices to protect confidential profitability information) is an easy way to begin the discussion and help a retailer understand the impact on your business. The best promotions are a win for the consumers, a win for the retailer, and a win for the manufacturer. Open and honest dialogue is critical to making this happen.

Embrace the Omnichannel Landscape

Gone are the days when you just add more displays or get another feature ad to earn more volume. The omnichannel landscape demands more than traditional merchandising vehicles, and omnichannel planning requires experts from marketing, sales, and digital commerce to collaborate and evaluate which available tactics will drive the most incremental sales.

Once the underperforming in-store promotions have been identified, funds are freed up to reallocate toward more efficient tactics, which can include shopper marketing and digital overlays that attract a variety of shopper groups and amplify promotion impact, resulting in comprehensive benefits for retailers and increased profits for manufacturers.

Reimagining a new promotion plan and strategy won’t happen overnight. It’s a journey that requires collaboration between the brand and the retailer, ensuring that both share in the profit and growth. We’ve supported countless clients through difficult conversations with retailers as they discuss changes and adjustments to strategies. A successful solution begins with bringing data and insights to the conversation.

Next Up: Driving Sales and Profitability

In part two of our multi-part series, we explore ways to further probe omnichannel tactics aimed at driving sales and profitability.

Questions we’ll cover include:

- Where do I start when building an omnichannel strategy and plan?

- How do I build a strong digital shelf presence?

- What are the tips for understanding the omnichannel landscape for my category or brand?

- What are some examples of successful omnichannel promotion planning?