2024 Retail Predictions: Strategic Insights For Success

By Colin Stewart, EVP Business Intelligence and Kathy Risch, SVP Shopper Insights

This year will be a mixed bag for shoppers. While some are optimistic, one in four are unsure if it will be a good or tough year. Amidst this consumer uncertainty, Acosta Group offers five retail predictions informed by its proprietary Shopper Community survey research to help manufacturers, retailers and restaurants connect with customers and drive growth.

1. Driving Growth Will Take Standout Creative Measures

In 2024, growth is no longer a given. We predict that growth will be driven by those who attract shoppers’ attention with creative value propositions that stand out from the competition.

Across generations, shoppers will continue to feel a spending pinch.

Less is more for shoppers in 2024, when we will see recessionary behaviors continue, manifested in cautious consumer spending. According to Acosta Group’s research, consumers continue to eat out less, spend less on discretionary items, and delay or cancel major purchases or travel. The reason? Bigger financial priorities leave less for discretionary spending. Gen Z is adapting to reinstated student loan payments. With high mortgage rates, Millennials struggle to buy homes, and Boomers are concerned about funding their retirement.

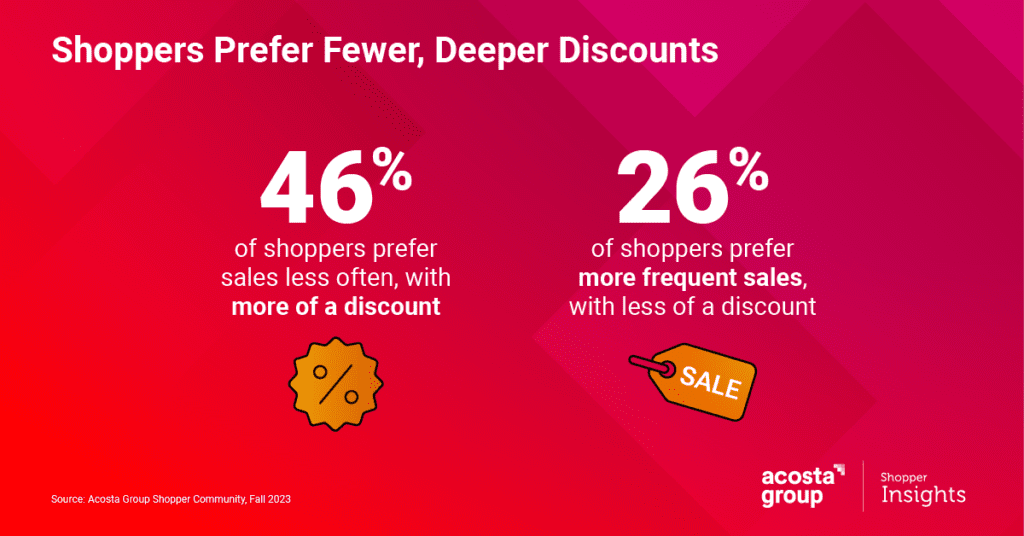

With limited funds, bargain hunting will continue to be necessary. When it comes to promotions, shoppers prefer depth to frequency.

Who is leading the way with standout creative value propositions?

Across industries, firms are developing innovative ways to capture consumers’ dollars through standout creative and added-value offerings. For example, Tums’ “Halftime Heroes” campaign has the brand partnering with food delivery platform Gopuff to enable the easy ordering of Super Bowl menu essentials alongside free delivery of fast heartburn relief from Tums in under an hour.

Restaurants such as Bojangles and Olive Garden seek to make it more affordable for families to eat out. For example, Bojangles offers value meals that feed more than one person, and Olive Garden’s family bundle meals can serve up to 12 people.

“Brands that look to non-traditional partnerships outside their category can breakthrough in ways that will drive brand affinity and strengthen consumer engagement.”

What are the opportunities to stand out in 2024?

To drive growth with standout creative measures, Acosta Group recommends:

- Manufacturers shift to a purposeful “collective spending model” across traditional advertising, digital media and trade promotions. Learn more about approaching this complex problem in Acosta Group’s “A New Approach to Marketing and Trade Spending Models.”

- Retailers find creative ways to build loyalty with points and rewards.

- Prioritize smart promotions that drive units and consumption, such as selective bundling focused on price points that resonate with shoppers.

- Deploy and evolve revenue growth management practices by optimizing price/promotion and assortment mix.

2. Seamless Retail Redefines Shopper Delight

Shopping is no longer a linear experience. We predict that in-store and online shopping will continue to blend, fueled by ubiquitous digital influence. Retailers must deliver a seamless experience across channels to win shoppers’ dollars and loyalty.

Consumers will embrace digitally enabled, channel-agnostic shopping.

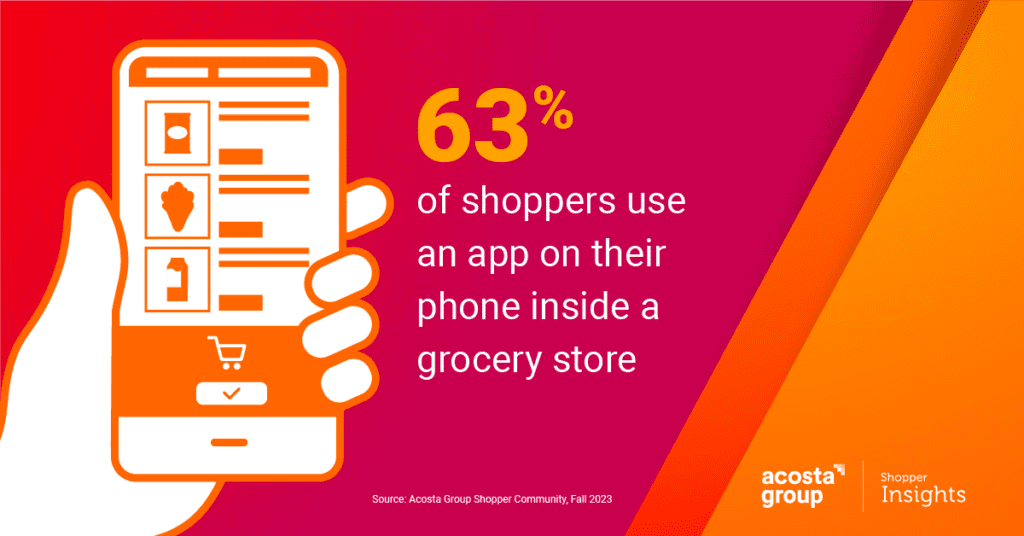

Shoppers don’t think of themselves as omnichannel shoppers, and they don’t separate online or in-store. They just want to shop. Younger, digital native shoppers have high digital expectations, while older shoppers are learning to enjoy the convenience digital brings. The phone is part of the shopping experience, whether ordering online or shopping in-store. Almost two-thirds of shoppers use an app on their phone inside a grocery store to compare products or check prices. For Gen Z and Millennials, it’s four out of five.

How are retailers providing a seamless shopping experience?

The best solutions are personalized, delivering what customers want or need. For example, Target offers convenience through its Drive Up app. In response to overwhelming customer demand, Target customers can now return unwanted items and add their favorite Starbucks drink to their drive-up order. Dollar General helps customers manage their budgets. The retailer’s app features a “cart calculator” that keeps a running total of what’s in a shopper’s cart, so they can make choices before they get to the cash register.

“Brands that provide personalized solutions seamlessly across touchpoints will build loyalty.”

What are the opportunities for seamless omnichannel retail in 2024?

To create a seamless experience that delights consumers:

- Boost digital shelf presence with search-optimized product page keywords, multiple images and videos. Ensure you adhere to retailer-specific requirements and best practices.

- Invest in omnichannel data. While still messy, omnichannel data is getting better. Don’t wait for it to be perfect. Find the right partners, clarify your business questions and then identify the best data to answer them.

- Test and learn different retail media options to see what works for your business.

3. Artificial Intelligence Propels Retail Efficiency and Shopper Experience

AI truly captured headlines in 2023. We predict that AI will drive widespread efficiencies across grocery retail and create a better shopping experience in 2024.

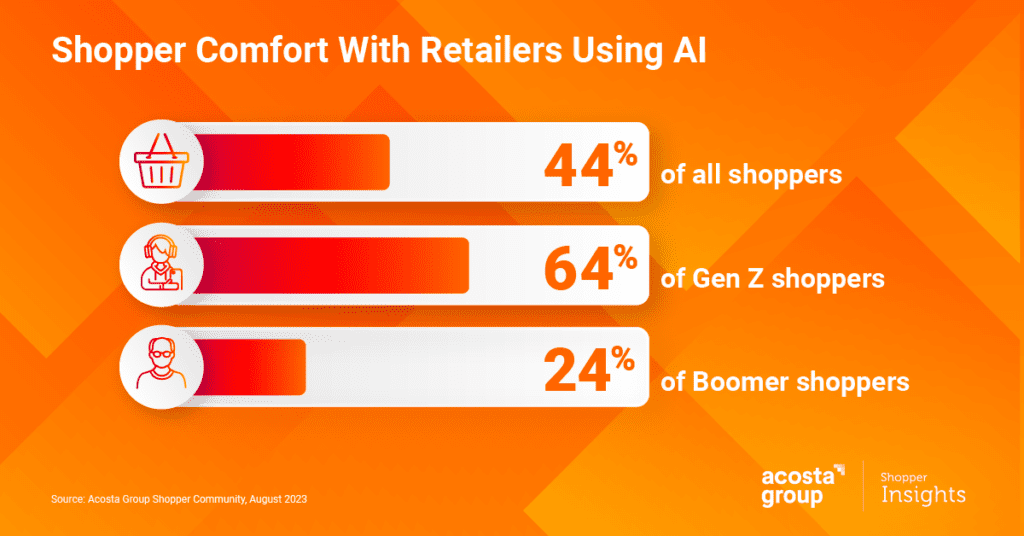

Shoppers will embrace AI if they think it serves their interests.

Shoppers are comfortable with retailers using AI to improve their shopping experience if it saves them money, such as budgeting or rewards. Younger shoppers, in particular, are quick to adopt AI-enabled shopping. According to Acosta Group’s Shopper Community, the majority of Gen Z and Millennial consumers have used AI tools while shopping, such as personalized recommendations and automatic scanner walk-out payments. Older generations, however, remain skeptical of AI.

How are retailers and manufacturers using AI to improve the customer experience?

AI doesn’t have to replace humans. In fact, human-machine collaboration can streamline tedious tasks or offer more personalized, relevant offerings. Manufacturers like Coca-Cola use AI for product creation. Its new Y3000 drink was co-created with human and artificial intelligence, using AI to glean insights from fans’ vision of the future.

Walmart Canada’s AI solution uses in-store cameras to scan shelves for out-of-stock items, then alerts store associates to restock shelves promptly. Online grocery service Hungry Root offers a personalized shopping experience at scale, powered by AI. Its AI algorithm selects 70% of customers’ purchases, determining the ideal grocery basket for each customer based on their diet and flavor preferences. It’s a win-win, saving customers money with less waste and benefiting the retailer with less spoilage.

What are the opportunities for AI in 2024?

The opportunities for AI are so vast they can be overwhelming. Think of AI as a journey, not a destination. Prioritize AI use cases based on your business needs. For example:

- Optimize local store assortments based on regional needs.

- Personalize product recommendations or offers.

- Streamline repetitive retail tasks to free up associates to deliver more value-added, high-touch customer service.

4. Shoppers Prioritize What’s NOT in their Products

Legislation is accelerating a growing trend toward clean labeling, as new FDA Cosmetics Modernization and CA Food Safety regulations come into effect. Many shoppers are already on board, and we predict the clean label trend will extend beyond food to other product categories in 2024.

Consumers won’t wait for legislation; they are already seeking clean ingredients.

Natural and organic shoppers’ values will go more mainstream in 2024 as they seek clean ingredients and products free of “bad” things. Our research shows that 61% of shoppers want clean ingredients, while 58% want products that are free of synthetic or artificial ingredients.

“Consumers are becoming more aware of the availability of better and cleaner products in other countries. The more informed consumers are, the better choices they will make for themselves and their families.”

Who is leading the way in clean ingredients?

Trade-offs between taste and health are no longer required. Goodles updated a classic Mac & Cheese dish, removing harmful ingredients and supply chain contaminants while adding more protein, fiber and plant-derived nutrients. The result? A rating of 4.8/5.0 in over ten thousand customer reviews. Dave’s Killer Bread ingredient-focused messaging tells customers what’s not in their bread (like high fructose corn syrup) and what is (whole grains, USDA organic).

Retailers and restaurants can make it easy for customers to make healthy choices by taking the work out of it for them. Whole Foods has been doing this since 1980, banning more than 260 food ingredients from its grocery products. Panera promotes clean, wholesome foods with its “No No List,” calling out over 70 ingredients banned from its bakery-café and grocery store products.

What are the opportunities for clean ingredients in 2024?

Lean in now to shoppers’ desire for cleaner labels. Don’t delay until legislation forces manufacturer and retailer compliance.

- Manufacturers should highlight searchable listings of what’s not in their products, as well as what is. Plus, prominently call out ingredients on product packaging.

- Retailers can leverage AI to create customized lists for their shoppers based on the absence of ingredients.

- While many consumers lead the way on clean ingredients, enlighten those who may need additional education through promotions and social media.

5. Retailers Turn Up the Heat to Attract Diners

With discretionary spending squeezed, consumers are seeking out affordable, restaurant-quality solutions. We predict that in 2024, the lines between retail and traditional foodservice will continue to blur, but with a new twist. Retail partnerships with local restaurants result in a win for retailers, a win for restaurants and–most importantly–a win for consumers.

Consumers will seek a blend of retail-restaurant dining

The cross-over trend of retail dining will continue from supermarkets to convenience stores. 48% of consumers don’t eat out because prices are too high, but they still want the convenience of not cooking, especially busy families. Just over a third of families eat out because they don’t have time to cook.

For Gen Z, restaurant retail offers a budget-friendly option as they can’t always afford to go out to eat. It’s a convenient time-saver for other generations, providing busy Millennials with a one-stop shop for groceries and dinner, and offering cooking-weary Boomers a tasty, no-fuss home-dining option.

Consumers’ perception of retail and convenience store-prepared food is on the rise. Our research shows that over four in ten consumers believe freshly prepared food at grocery stores is up to par with restaurants, and a third agree that the quality has increased in recent years. Just under a third of consumers also tell us that convenience stores’ hot meals are just as good as fast food or quick-serve restaurants, and the quality of freshly prepared food in C-stores has increased in recent years.

How are retailers attracting diners?

While there is real competition for diners’ dollars, retailers and restaurants see the benefit in coming together to offer consumers more dining choices, variety, quality and convenience.

The trend towards food hall-style foodservice will continue in 2024. Midwest retailer Schnucks created a food hall featuring favorite local restaurants like Seoul Taco with meals that can be ordered online ahead of time from the participating restaurant’s website. In California, Northgate Markets opened a supermarket with a Mexican food hall featuring over 20 food stalls, live music and fine dining from local vendors, chefs and restaurants. The challenge for restaurants and retailers alike will be staffing resources to sustain these innovative offerings.

What are the opportunities for retail dining in 2024?

As the retail and restaurant lines blur, create innovative, budget-friendly solutions for shoppers:

- Elevate the in-store experience to be a place customers want to hang out. Younger customers appreciate a selection of dining options and a vibrant atmosphere to get together with friends for a budget-friendly, no-tab-splitting meal. Partner with local restaurants and chefs for appealing store-dining solutions.

- Make it easy for busy Millennials to assemble a quick, budget-friendly family dinner with meal solutions and cross-promotions combining different departments, such as fresh-prepared, bakery and frozen produce. Even better, integrate it with digital online ordering for curbside pickup.

Sources

- Acosta Group “The Why? Behind The Buy” Shopper Community Survey, 2022 and 2023

- Acosta Group, Financial Wellness, 2023

- Acosta Group, Foodservice Diner Insights, 2023

Follow Acosta Group on LinkedIn to ensure you never miss an update.