Driving Sales and Profitability With Your Omnichannel Strategy and Plan

By John Carroll, Acosta Group President Connected Commerce + Advanced Analytics

Previously, we discussed the importance for manufacturers and retailers to reinvent the siloed trade spending model and replace it with an omnichannel model that embraces collective involvement from sales, marketing and e-commerce leaders. We suggested analyzing current trade efficiency and ROI to identify improvement opportunities. We also highlighted the need to test and learn new in-store promo tactics, be open and honest in discussions with retailers and move away from the anniversary method of continuing the same promotions year in and year out that have been declining in effectiveness for years.

More Scrutiny Brings More Opportunity

While headlines scream of shopper stress and recessionary behavior, earnings reports from manufacturers mention expanding profit margins. Retailers are in the middle, and some demand that manufacturers invest more in digital and/or accept higher trade rates. Manufacturers are feeling the pressure and picking up hints that refusing to increase investments with retailers could lead to a loss in distribution or reciprocal refusal to stock new products. Although retailers prefer to share profits alongside manufacturers, they also need to protect basket sizes and trip frequency by keeping prices as low as possible. The cycle of behavior and response keeps churning.

Acosta Group is positioned between manufacturers and retailers in this cycle, where we collaborate with both sides to generate a win-win proposition. Our teams have encountered circumstances involving escalated demands, such as increasing trade rates by three percent, asking for a threefold increase in retail media network digital spending, or expecting both trade and digital investment increases.

You can imagine the alarm of the situation and the stress that comes with it when layered on top of the omnipresent second-guessing within CPGs about where best to spend to achieve incremental growth. When you find yourself in a situation like this, what can you do to move from a contentious relationship to one of collaboration that ensures the needs of both the CPG and retailer are met while keeping an eye on the shopper?

Invaluable Tactics to Increase Sales and Profitability

The first step in developing your omnichannel strategy and plan is to have a strong digital shelf presence. According to research from grocery doppio, 69% of all grocery sales are digitally influenced, making the digital shelf as important as the physical shelf when it comes to the overall purchase journey.

The digital shelf often needs more attention than the physical one due to its complexity and constant fluctuations. Many resources are dedicated to category analysis and SKU rationalization of the physical shelf, even though it typically changes only once or twice per year.

In contrast, the digital shelf is often an afterthought. The digital shelf is far more dynamic and is continuously evolving. It is critical to dedicate appropriate resources to ensure your products are set up correctly and show up in the consideration set for omnichannel shoppers. Or, when your team is already spread too thin, it’s vital to find a partner who can do this essential work for you.

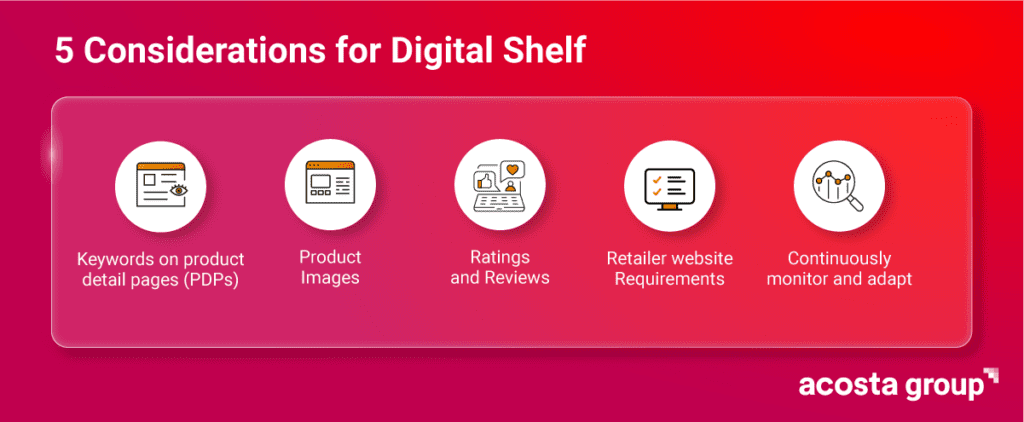

5 Considerations for the Digital Shelf:

1. Keywords on your product detail page (PDP): Ensure your PDPs include key category, brand and item search terms so your products have a better presence on the retailer’s site. To maximize search relevance and help your products appear in more prominent positions where shoppers can see them, review how the retailer’s site algorithm works. It will determine where best to place specific keywords on your PDP.

2. Your product images: Whether the purchase happens in-store or online, shoppers view your products’ pages before making a final decision. The right kinds of images on your PDP can increase engagement and inspiration.

Include relevant portions of your product packaging. You need a hero image and shots of important shopper-desired information, such as a nutrition panel or ingredients, that helps the shopper quickly identify the product’s value proposition.

Additional images should include infographics or lifestyle and product-use photos or videos.

3. Ratings and reviews: Understand and leverage the influence of your customers’ experience. According to a Bazaarvoice survey of 30,000 global shoppers, 89 percent responded that they always or most always consult ratings and reviews before purchasing. Eighty-five percent also consulted online product reviews on their phones while shopping in-store. Quantity and recency of reviews were very important, with one-third of shoppers expecting over 100 reviews for a product to seem credible. Quality of reviews is also important and is defined by Bazaarvoice as sentiment plus visuals plus authenticity. Reviews that meet quality standards are more likely to engage and ultimately convert shoppers toward purchase.

Acosta Group has a first-of-its-kind partnership with Bazaarvoice to enable brands to implement social commerce tactics. For more insights on ratings and reviews, see Why ratings and reviews are important for your business (bazaarvoice.com).

4. Retailer website requirements: Each retailer has unique site requirements for images, character limits, and sourcing of search terms (e.g. pulled from titles vs. descriptions). Customizing your PDP for each retailer’s specific requirements is critical. However, while there are nuances in how the PDP looks across the various retailers, consistency in the brand assets used across all retailer sites is essential. The shopper will often view your product on multiple retailer sites. Disparities in their brand experience can diminish brand equity and loyalty because the shopper doesn’t know which content is “right.” To maximize recognition and engagement, it’s also vital to ensure brand consistency across all retailers’ digital and physical shelves.

5. Continuously monitor and adapt: Maintaining a robust digital shelf presence requires regular monitoring of retailer requirements and competition activity so you can nimbly respond to the ever-changing landscape. It’s wise to audit how your content and PDPs compare to the competition across various retailer sites to remain competitive and have engaging shopper-focused content to drive toward purchase. You can do this manually or by using automated scraping tools.

Navigating the Omnichannel Landscape

A robust digital shelf presence? Check. Consistent content? Check. Now, you must understand the omnichannel landscape for your category, brand, and products across all relevant retailers. We have in-store data up to our eyeballs, coming out of our ears, and (insert your favorite overabundance metaphor here). The challenge is the quality of e-commerce data, where receipt panel data is less accurate than the point of sale (POS) data we are accustomed to devouring.

The solution? Gather as much information as you can from multiple sources and prepare your organization to be comfortable making decisions from ambiguous data and pivoting as updates roll in. Strategies need to be fluid and adjustable to accommodate the inevitable evolution of the landscape.

3 Tips for Understanding the Omnichannel Landscape:

Tip #1: Educate yourself on available data sources. The top data providers have exclusive access to data from different retailers, which means all data providers have gaps in coverage. To overcome these gaps, leverage multiple data partners to gather a more complete picture of your e-commerce performance.

Tip #2: Clarify the business questions that need to be answered to inform your omnichannel strategy. There’s no point in trying to boil the ocean—clearly define the problem that needs to be solved, and you’ll point yourself to the essential data sources. Determine which questions are nice to know versus truly need to know, and you’ll drive clarity for the organization.

Tip #3: Accept that e-commerce data is directional and has a primary role: to help you make better strategy decisions and plan with a more calculated chance of driving results and success. The exception is e-POS data, which has the same accuracy as in-store POS data. Make sure to clarify sources so your organization understands the accuracy level and how to use the data to make the best decisions.

Without Data, How Informed Are We?

To help our clients with their strategic investments, Acosta Group combines its expert knowledge of in-store and digital performance from across the retailer landscape with the many data sources we are licensed to leverage. This includes, but is not limited to, e-commerce data, Kantar, Mintel, Statista, EMARKETER, category projections, and customized research powered by our proprietary Shopper Community of 40,000 shoppers. Pairing our experience and access to data with our clients’ KPIs (key performance indicators) and goals for their individual brands enables the development of a data-informed omnichannel strategy that feeds comprehensive tactics and plans.

Once you are confident in your digital shelf presence and understand the omnichannel landscape for your brands and categories, it is imperative to ensure measurable results by developing a strategy based on data-informed recommendations.

Look at it this way: our first article of this series discussed improving in-store trade efficiency by focusing on in-store promotion performance and ROI. Now consider the importance of online shopping to the overall shopper journey—both online and in-store. The logical next step is to add a digital overlay to amplify those same in-store promotions that drive sales volume. Let’s examine examples of how Acosta Group has helped clients implement successful omnichannel planning.

The case of the lonely TPR.

One CPG client was offering an in-store TPR (temporary price reduction) and wanted to boost the impact without additional lump sum investments. We recommended adding a digital coupon, which secured in-store display and print ad support. The client saw 30-40 percent digital coupon redemptions—much higher than industry averages—which proves it is truly driving in-store engagement, and the TPR store displays support the lift by ensuring adequate stock in multiple places. The brand also gets a special “digital coupon” tag on the shelf, which sets it apart from other sale tags. Ultimately, the digital promotion impacts store sales, and the brand stands out.

The case of the invisible product.

Another client needed help enhancing product discoverability and boosting conversions. Our Digital Strategy Manager analyzed how well the client’s product attributes and categories correlated with retailer site search terms and then implemented precise changes across client PDPs. This led to amplified visibility with a 10 percent share of views (share of voice) across the retailer’s desktop, mobile, and native app platforms, achieving improved online penetration that reached 21 percent. Not only did this drive online sales revenue, but the ship-from-store sales revenue increased six percent as well.

The case of the September redemption.

A third client wanted to increase brand awareness and drive coupon redemptions during September. We developed and executed a retailer-specific media program to drive sales using an online coupon. The program delivered a digital coupon redemption rate of 53 percent—a sixfold increase from that retailer’s average. Twenty-eight percent of shoppers were new to the brand with 35 percent of shoppers trying a new UPC for the first time in 52 weeks.

Give Opportunity a Longer Shelf Life

As you consider your own examples of data-informed tactics, remember that adding digital support to in-store promotions will drive omnichannel performance. Try new ideas and tactics. Measure the outcome. Then, report your findings to the retailer.

What worked? What needs improvement? Remember to look at the big picture—CPGs often miss opportunities for synergy between in-store and online plans.

Double-check: are separate teams with separate budgets running separate in-store and e-commerce strategies? Trade spending power occurs when you remove channel silos and multi-functional teams invest together to drive amplification and incremental growth.

Next Up —the ABCs of RMNs.

In part three, we dig into Retail Media Networks (RMNs), one of retail’s hottest topics. RMNs are often a key component of omnichannel strategy and planning, so how do we leverage them effectively and efficiently?

Questions we’ll cover include:

- What do I do if a retailer demands a higher trade rate or higher digital/RMN investment?

- Which RMNs should I invest in? Which can I ignore?

- What is the best way to allocate spending across marketing, digital, and trade?