From Surviving To Thriving: Shoppers Adapt to a Contracting Economy

Consumer confidence levels are on the rise mid-year, yet economic uncertainty, recession fears and rising prices continue to take a significant toll on consumer sentiment. In January, Acosta Group predicted that recessionary behaviors would continue in 2023 and that shoppers would seek enjoyment, convenience and value in their paths to purchase. Now, Acosta Group has identified three unique consumer segments from its proprietary Shopper Community research: Surviving, Steady and Thriving. This research reflects consumers’ perspectives on the impact the economy has had on their financial health and how it has informed their attitudes, behaviors and expectations in 2023. We reveal what retailers and brands can do to ease consumers’ challenges.

Recession Fears Dampen Consumer Sentiment

In 2023, consumers continue to be cautious amid a post-COVID period of rising interest rates, mixed job market signals and the lingering threat of a recession. Although inflation continues to soften, consumer sentiment continues to trend downwards.

Shoppers Feel the Burden of Economic Uncertainty

Economic uncertainty and rising prices are taking their toll on consumers. Many shoppers think the U.S. is already in a recession or will be soon. They are already paying more for everything from healthcare to housing and utilities. Shoppers tell us that:

- They are cutting back. Shoppers continue to spend less across the board, from eating out to entertainment, from discretionary purchases to travel. The silver lining is that these cutbacks are lower than seen last year, implying some optimism for more financially secure shoppers.

- Food insecurity is a big problem. Four in 10 shoppers struggle to buy nutritious food; they eat less fresh meat (48%) or produce (37%) because of higher prices. This is particularly pronounced for SNAP (Supplemental Nutrition Assistance Program) recipients; Over half struggle to buy nutritious foods for their families.

- Physical and mental health is suffering. Nearly one in five shoppers report that their physical or mental health is fair or poor.

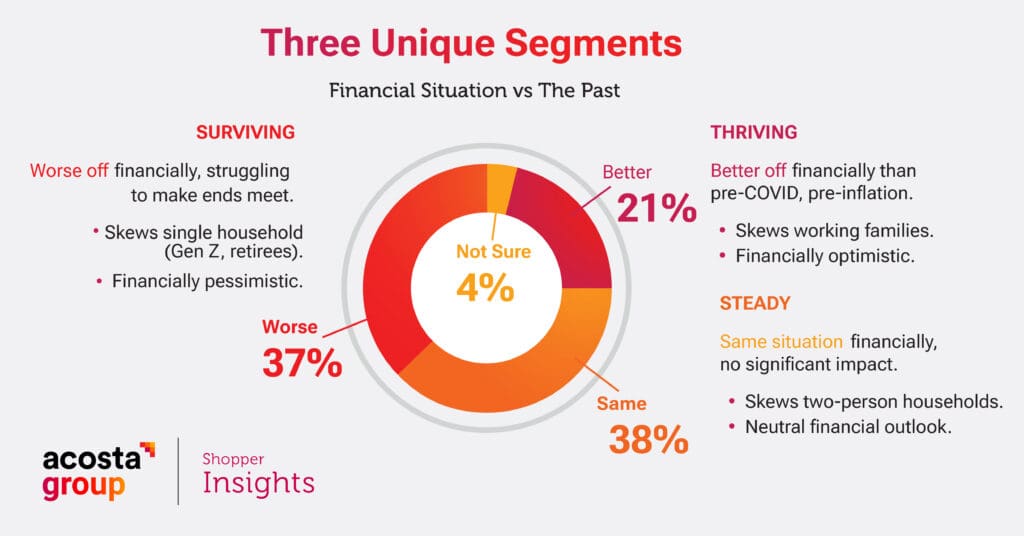

Three Segments of Consumers Emerge: From Surviving to Thriving

This Surviving, Steady and Thriving segmentation is based on how shoppers’ changing financial situations have informed their current attitudes, behaviors and expectations.

Our research shows:

- The financial situation is not improving. The economic situation is the same or worse for most. Almost 40% of shoppers are worse off financially than before, but 20% say their financial situation is better.

- Working hours have increased. The Surviving segment is trying to make more money—they are more likely to work extra hours, take on a second job, and look for a better-paying job. The Thriving segment has had success making more money. They are working extra hours and a second job, while some have already started a better-paying job.

- Income is not the only factor. This is not a tale of haves and have-nots. There are higher-income households that are Surviving and lower-income households that are Thriving. 38% of Thriving households have less than $50K in household income, while 14% of Surviving households make over $100K.

Shopping Shifts From Fun to Frustrating

With higher prices and more demands on less income, shopping has become a chore rather than a fun activity. To combat increased costs, consumers are changing their shopping habits—four in ten now shop at discount grocery stores. But the most significant changes are how they shop, especially in the Surviving segment.

In this tight economy, shoppers:

- Hunt for deals in their regular store. Low prices remain the most critical factor for all segments, especially the Surviving segment. Four in ten of all shoppers buy cheaper brands, spend more time looking for deals and buy more store brands.

- Make trade-offs. Almost half of shoppers buy cheaper brands in one category to buy more expensive brands in another category, such as meat or coffee. As part of this trade-off, they are even willing to pay more for higher-quality products–especially the Thriving segment.

- Stick to the list, with an occasional splurge. Surviving shoppers are far more likely to stick to their list, while the Thriving segment will sometimes buy on impulse. But there is still room for an occasional splurge. Half of all shoppers splurge on dessert, ice cream or snacks. Shoppers even view staples like fresh meat and fresh produce as a splurge.

Dining Out Competes for Grocery Dollars

As consumers emerged from the pandemic, they quickly shed eating in for eating out. But with limited income and higher prices, the lines between dining in and dining out blur. Consumers now:

- Continue to eat out but trade down. In the post-pandemic era, diners continue to enjoy eating out but are cutting back on restaurant meals due to higher prices, with many seeking discounts or reducing their overall spend. They are also more likely to opt for quick-serve restaurants versus dining in.

- View fast food as cheaper than groceries. Despite rising restaurant prices, 36% of consumers say eating at fast food restaurants can be more affordable than cooking at home.

- Consider freshly prepared supermarket foods a viable option. Freshly prepared supermarket food is often a convenient and economical alternative to dining out for about six in ten, often on impulse (43%). Rotisserie chicken is a fan favorite. While yet to be on par with restaurant quality, the perceived quality of prepared supermarket foods has improved.

How Retailers and Brands Can Ease the Burden: Make it Easy

Shoppers want retailers to make it easier to shop. Most helpful? For 65% of shoppers–low prices on everyday staples. And around half want some form of a discount from loyalty program rewards or high-value digital or paper coupons. For example, Kroger’s new “Smart Way” brand offers basic groceries like sliced bread and mustard at the lowest price point. Drug stores such as CVS, Walgreens and Rite Aid promote exclusive digital deals through their loyalty programs, and Walmart strives to attract more customers to its subscription service, Walmart+.

Sources:

Acosta Group Financial Impact Shopper Segmentation, March and June 2023

Acosta Group Ongoing Challenges In The U.S. Labor Market, April 2023

Acosta Group Promotion Shopper Insights, March 2023

Acosta Group SNAP Insights & Impacts, April 2023

Acosta Group Foodservice Diner Insights, Spring 2023