Club Warehouses Reap the Benefit of a Shift in Shopper Trends

New research from Acosta Group’s proprietary Shopper Community shows American consumers are shopping around more frequently and spending more on routine household goods due to higher prices. They are seeking good value and prices that better fit their budget, with Millennials driving most of these increases.

Club Is a Routine Shopping Destination for Members

While bulk buying large sizes to stock up is still important to 28% of club members, many are now turning to the club channel for routine household shopping. Consumers tell us that:

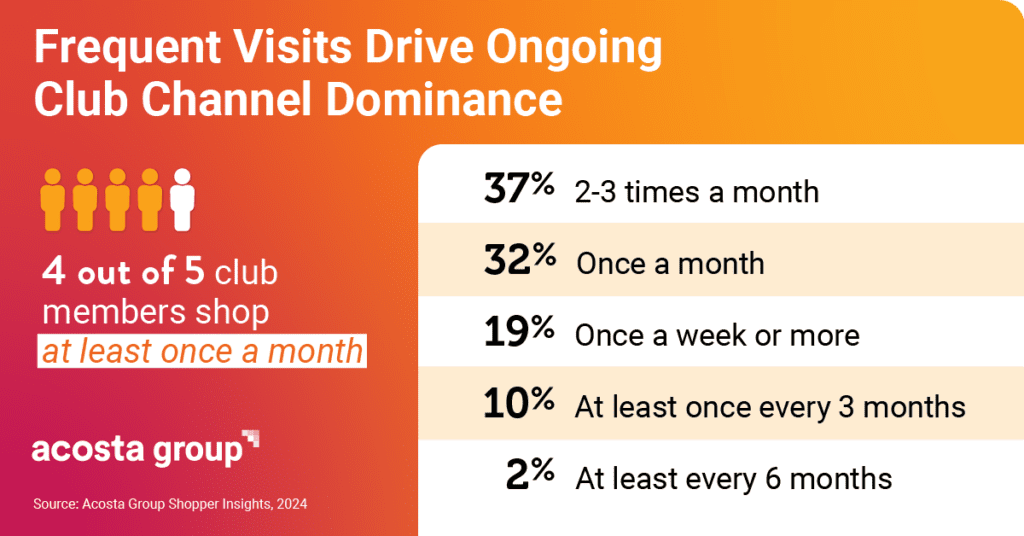

- Visits to warehouse clubs are more frequent. Four out of five club members shop their club at least once a month, and two out of three have increased club shopping trips at the expense of other stores. Compared to a year ago, 21% are shopping club more often.

- Club meets many household needs. In 2024, 28% of club members’ grocery and household needs were purchased at club.

- Value and one-stop shopping drive club visits. For more than half of members, club warehouses offer them the best value for their money. For 41%, the convenience of one-stop shopping is a top reason for visiting a club.

Club Members Find Value Across Multiple Categories

Household staples dominate club purchases, but fresh, natural and organics are increasingly important:

- Routine homecare products are a draw. About half of club members buy many routine homecare products at their club warehouse–from laundry to oral care. About half buy paper products—and a third exclusively buy them at club.

- Natural and organic offerings have broad appeal. Nearly half of club members purchase natural or organic groceries–especially older generations and parents of young babies. Fresh produce and dairy foods are the most popular.

- Shelf-stable foods are the most broadly shopped, but fresh foods are also popular. About two in three members buy salty snacks, fresh produce or dairy. Sixty percent buy bottled water—a third do so exclusively.

On-Site Services Make One-Stop Shopping a Reality

For many members, warehouse clubs offer more than good value; they also provide the convenience of one-stop shopping through various services:

- On-site services trigger club visits. For all or most trips, three out of four members go to a warehouse club specifically for the services, with in-store foods being the most popular.

- Convenience is a primary benefit. Members, especially younger ones, choose these services for the convenience of checking off errands while they shop. And three out of five like that they don’t have to search for an outside vendor.

- Healthcare services are the most popular. For those who use retailer-staffed services, pharmacy is the most popular. Rx pickup (55%), immunizations (45%) and vision care (44%) are also widely used.

Store-Prepared Foods Drive Club Warehouse Visits

About four out of five members buy store-prepared foods at their warehouse club. For most of these members, the convenience and quality that these items offer is a key factor in their visit:

- Most purchases of store-prepared food are planned. Almost two-thirds of members who buy store-made foods, especially younger members, plan these purchases ahead of time. Three out of four will consume the food quickly—even that day.

- Butchers and bakers are prime destinations. Just under half of members pick up bakery items or fresh meat.

- Freshly prepared foods attract younger generations. Gen Z members are likely to purchase freshly prepared foods on almost nine out of ten of their next club trips. Nearly four in five Millennials say that restaurant-quality prepared foods make a retailer more appealing.

Digital Channels Offer Convenience and Deals

Club members turn to online shopping and digital apps to enhance their shopping experience:

- Online shopping offers added convenience. Just under a third of members’ club purchases are made online. About a third of these online shoppers buy online several times a month and most opt for home delivery.

- Apps facilitate deal-seeking. Over two-thirds of members have downloaded their club’s digital app, which most use to seek out the best deals through digital coupons, promotions, and weekly specials. Some members value alerts that notify them of promotions and deals.

- Costco members are the most digitally engaged. Almost half shop Costco.com, 45% have the Costco app, and 42% receive digital alerts.

Club Members Are Loyal but Still Shop Around

Club members keep their membership year after year, but many belong to more than one club and shop around for deals:

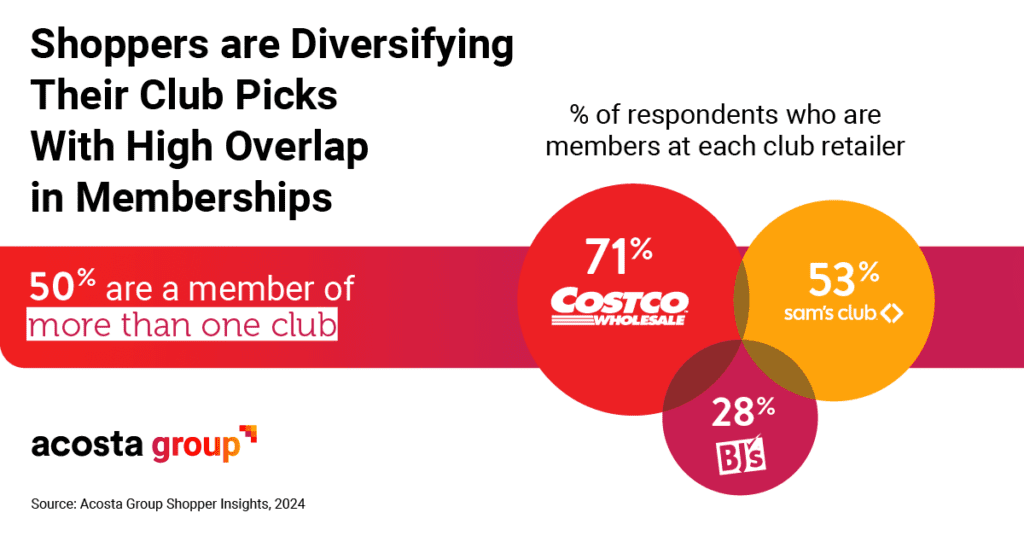

- Most members renew: About two-thirds have been members of their club for more than three years, and more than half of Costco members have been with the club for at least five years.

- Multiple club memberships are common. Half of club members belong to more than one warehouse club, seeking different product selections and perks. BJ’s Warehouse has the most multiple members per household.

Recommendations for Warehouse Clubs and Brands

As shopping habits evolve, warehouse clubs and their brand partners have a unique opportunity to enhance the member experience and drive loyalty. Based on Acosta Group’s research, here are actionable strategies for warehouse clubs and their brand partners to stay ahead:

- Broaden food offerings: Club shoppers are seeking a wider variety of food options. Expand natural, organic and healthier food offerings, as well as international store-prepared foods like Korean BBQ. More fresh food offerings will attract younger members, especially Gen Z. By meeting these demands, warehouse clubs can strengthen their positioning as a go-to destination for diverse food options.

- Enhance digital convenience for time-strapped shoppers: Digital checkout options and better delivery options can streamline the shopping experience and offer flexibility to members. Nearly half of Sam’s members prefer self-checkout, especially Gen Z. Scan & Go™—where members scan items in their cart and pay through the Sam’s Club app—is gaining favorability. However, Boomers still prefer standard checkout. DIY checkouts could further position Sam’s as a leader in digital checkout, but offering a blend of options ensures inclusivity.

- Expand one-stop shopping experience: A club visit is more than just a shopping trip; it’s a chance to check off other items on the to-do list—from routine healthcare to what’s for dinner. Continue to seek new ways to make warehouse clubs a destination for members’ lifestyle needs. Increasing alerts through their app could drive higher awareness of special promotions pre-trip.

- Adjust to new shopping behaviors with the right mix: Provide a variety of sizes to cater to routine shopping habits as bulk-buying declines. Ensure the right mix of products that align with everyday needs. Feature a blend of national and private-label brands to meet diverse member expectations.

Sources:

Acosta Group’s Shopper Community is comprised of over 40,000 demographically diverse shoppers across the U.S. and is our proprietary community for survey engagement. This report includes findings from the following studies:

- Acosta Group Shopper Community: 2024 Club Member Insights, July 2024

- Acosta Group Shopper Community: Cross-Channel Value-Driven Shopping, September 2024

- Acosta Group Shopper Community: Freshly Prepared Foods Shopper Insights, May 2024